CIBIL Rectification Services

Incorrect Personal Information

Incorrect Personal Information like name, address, date of birth etc will be corrected.

CIBIL errors can lead to higher interest rates, loan rejections etc. Hence, essential to correct it.

Inaacurate Account Details

Details like Incorrect loan amounts, payment history errors, unauthorised accounts etc will be corrected.

Ensures that lenders make informed decisions about your credit applications based on correct information.

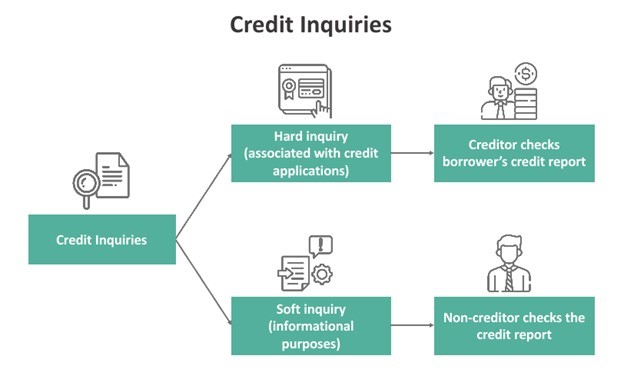

Unauthorised Inquiries

Inquiries on your report that you didn’t authorise or recognise etc will be corrected.

Could indicate identity theft or fraudulent behaviour, which need to be addressed promptly.

Duplicate Entries

Duplicate Entries like Multiple listings for the same credit account etc will be corrected.

These mistakes may restrict your ability to obtain new credit or favourable loan terms.

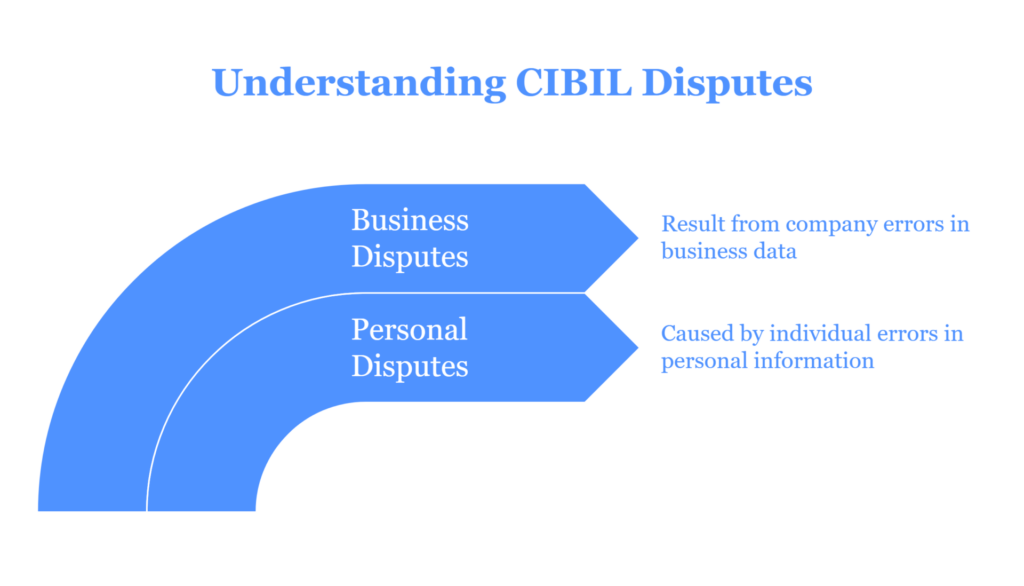

Dispute Resolution

CIBIL maintains credit information and generates credit reports for individuals.

All kinds of disputes with CIBIL will be resolved, which is essenial for financial health.

CIBIL Score Improvement

Credit report plays a crucial role in financial life, influencing your ability to get loans, credit cards, and other financial products.

We help our clients to improve their CIBIL score.